Grupa LOTOS S.A. - Integrated Annual Report 2012

Structure of the organization

{GRI 2.6., GRI 2.9.}

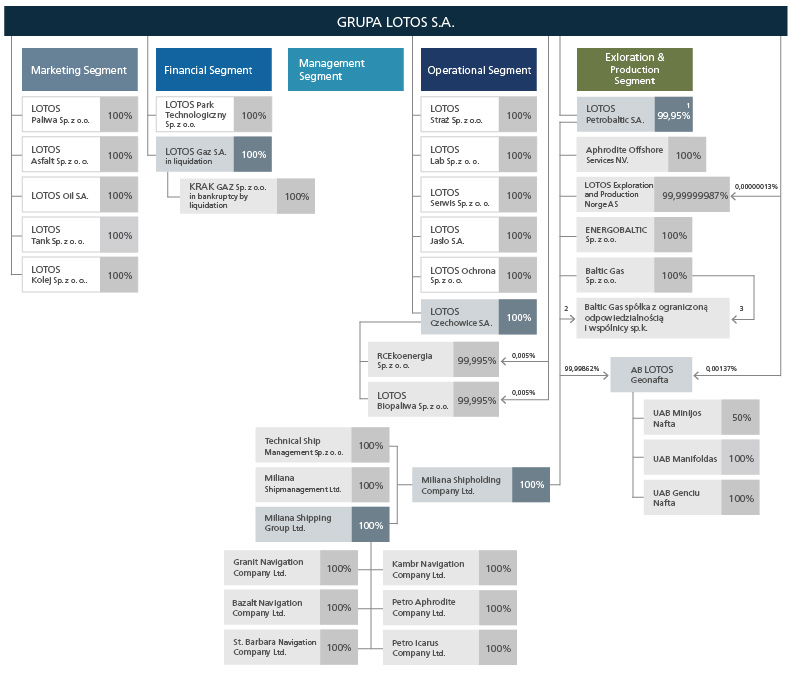

As at December 31st 2012, the LOTOS Group comprised Grupa LOTOS (the parent entity), and 34 production and service companies, including:

- 14 direct subsidiaries of Grupa LOTOS,

- 20 indirect subsidiaries of Grupa LOTOS.

Grupa LOTOS also holds shares in a jointly-controlled entity.

Subsidiaries comprising the LOTOS Group

| Company name | Registered office | Business profile |

Method of consolidation |

Percentage of share capital held by Grupa LOTOS |

|

|---|---|---|---|---|---|

| Dec 31 2012 | Dec 31 2011 | ||||

| Parent | |||||

| Grupa LOTOS S.A. | Gdańsk | Production and processing of refined petroleum products (mainly fuels) and their wholesale | Not applicable | Not applicable | Not applicable |

| Direct subsidiaries | |||||

| LOTOS Paliwa Sp. z o.o. | Gdańsk | Wholesale and retail sale of fuels and light fuel oil, management of the LOTOS service station chain | full | 100.00% | 100.00% |

|

LOTOS Gaz S.A. w likwidacji (in liquidation) |

Kraków | Dormant | full | 100.00% | 100.00% |

| LOTOS Oil S.A. | Gdańsk | Production and sale of lubricating oils and lubricants, and sale of base oils | full | 100.00% | 100.00% |

| LOTOS Asfalt Sp. z o.o. | Gdańsk | Production and sale of bitumens | full | 100.00% | 100.00% |

| LOTOS Kolej Sp. z o.o. | Gdańsk | Rail transport | full | 100.00% | 100.00% |

| LOTOS Serwis Sp. z o.o. | Gdańsk | Maintenance of mechanical and electrical systems and controlling devices, overhaul and repair services | full | 100.00% | 100.00% |

| LOTOS Lab Sp. z o.o. | Gdańsk | Laboratory analyses | full | 100.00% | 100.00% |

| LOTOS Straż Sp. z o.o. | Gdańsk | Fire safety | full | 100.00% | 100.00% |

| LOTOS Ochrona Sp. z o.o. | Gdańsk | Personal and property protection | full | 100.00% | 100.00% |

| LOTOS Parafiny Sp. z o.o. | Jasło | Production and sale of paraffin | full | - (1) | 100.00% |

| LOTOS Tank Sp. z o.o. | Gdańsk | Until October 16th 2011 - trading in aviation fuel, since January 1st 2013 - logistics services | full | 100.00% | 100.00% |

|

LOTOS Czechowice S.A. (parent of another group: LOTOS Czechowice Group) |

Czechowice-Dziedzice | Storage and distribution of fuels | full | 100.00% | 100.00% |

| LOTOS Jasło S.A. | Jasło | Storage and distribution of fuels Renting and operating of own or leased real estate | full | 100.00% | 100.00% |

|

LOTOS Petrobaltic S.A. (parent of another group: LOTOS Petrobaltic Group) |

Gdańsk | Acquisition of crude oil and natural gas deposits and their exploitation | full | 99.96% (2) | 99.95% |

|

LOTOS Park Technologiczny Sp. z o.o. |

Jasło | Dormant | full | 100.00% | 100.00% |

| Indirect subsidiaries | |||||

| RCEkoenergia Sp. z o.o. | Czechowice-Dziedzice | Production and distribution of electricity, heat and gas | full | 100.00% | 100.00% |

| LOTOS Biopaliwa Sp. z o.o. | Czechowice-Dziedzice | Production of fatty acid methyl esters (FAME) | full | 100.00% | 100.00% |

|

Miliana Shipholding Company Ltd. (parent of another group: Miliana Shipholding Company Group) |

Nicosia, Cyprus | Storage and transport of crude oil, other sea transport related services, and management of own financial assets | full | 99.96% (3) | 99.95% |

|

Technical Ship Management |

Gdańsk | On October 1st 2012, the company launched sea transport support activities involving advisory on the operation of ships, | full | 99.96% (3.4) | 100.00% |

| Miliana Shipmanagement Ltd. | Nicosia, Cyprus | Provision of sea transport and related services | full | 99.96% (3) | 99.95% |

|

Miliana Shipping Group Ltd. (parent of another group: Miliana Shipping Group Group) |

Nicosia, Cyprus | Management of own assets | full | 99.96% (3) | 99.95% |

| Bazalt Navigation Co. Ltd. | Nicosia, Cyprus | Ship chartering | full | 99.96% (3) | 99.95% |

|

Granit Navigation Company Ltd. |

Nicosia, Cyprus | Ship chartering | 99.96% (3) | 99.95% | |

|

Kambr Navigation Company Ltd. |

Nicosia, Cyprus | Ship chartering | full | 99.96% (3) | 99.95% |

|

St. Barbara Navigation Company Ltd. |

Nicosia, Cyprus | Ship chartering | full | 99.96% (3) | 99.95% |

| Petro Icarus Company Ltd. | Nicosia, Cyprus | Ship chartering | full | 99.96% (3) | 99.95% |

|

Petro Aphrodite Company Ltd. |

Nicosia, Cyprus | Ship chartering | full | 99.96% (3) | 99.95% |

| LOTOS Exploration and Production Norge AS | Stavanger, Norway | Oil exploration and production on the Norwegian Continental Shelf, provision of services related to oil exploration and production | full | 99.96% (3) | 99.95% |

|

Aphrodite Offshore Services N.V. |

Curaçao, Netherlands Antilles | Dormant since October 17th 2011 | full | 99.96% (3) | 99.95% |

| Energobaltic Sp. z o.o. | Władysławowo | Production of electricity, heat, LPG and natural gas condensate | full | 99.96% (3) | 99.95% |

|

AB LOTOS Geonafta (parent of another group: the AB LOTOS Geonafta Group) |

Gargždai, Lithuania | Crude oil exploration and production, drilling services, and purchase and sale of crude oil | full | 99.96% (3) | 99.95% |

| UAB Genciu Nafta | Gargždai, Lithuania | Crude oil exploration and production | full | 99.96% (3) | 99.95% |

| UAB Manifoldas | Gargždai, Lithuania | Crude oil exploration and production | full | 99.96% (3.5) | 49.98% |

| Baltic Gas Sp. z o.o. | Gdańsk | The company has not commenced operations | non-consolidated (6) | 99.96% (3.6) | - |

| Baltic Gas spółka z ograniczoną odpowiedzialnością i wspólnicy sp.k. | Gdańsk | The company has not commenced operations | non-consolidated (7) | 99.96% (3.7) | - |

| Jointly-controlled companies | |||||

| UAB Minjos Nafta | Gargždai. Lithuania | Crude oil exploration and production | proportional | 49.98% (3) | 49.98% |

(1) On January 10th 2012, 100% of shares in LOTOS Parafiny Sp. z o.o. were sold to a third party, Krokus Chem Sp. z o.o. As an additional element of the transaction, on November 29th 2011, the parties signed a seven year agreement for the supply of slack waxes by Grupa LOTOS S.A. to LOTOS Parafiny Sp. z o.o., for the period from January 1st 2012 to December 31st 2018. The estimated net value of the agreement is PLN 780m. The maximum net value of contractual penalties is estimated at PLN 98m. The agreement does not contain any provisions which would prevent the parties from seeking additional compensation beyond the contractual penalties. The other terms and conditions of the contract do not differ from the terms and conditions commonly applied in agreements of this kind.

(2) In exercise of its pre-emptive rights, on December 15th 2011 Grupa LOTOS S.A. subscribed for the newly issued Series C shares of LOTOS Petrobaltic S.A. Grupa LOTOS S.A. subscribed for 279,996 shares in the increased share capital of LOTOS Petrobaltic S.A., with a total value of PLN 53,980,000. The increase in the share capital of LOTOS Petrobaltic S.A. was registered on February 2nd 2012.

Grupa LOTOS S.A. also continued purchasing shares from non-controlling shareholders as part of the voluntary share purchase process, which was completed at the end of March 2012. From January 1st 2012 to the completion of the voluntary share purchase process, Grupa LOTOS S.A. acquired 26 shares in LOTOS Petrobaltic S.A. with an aggregate value of PLN 3,000, representing 0.0003% of the company's share capital.

With respect to the remaining shares held by non-controlling shareholders, excluding the shares held by the State Treasury, on May 8th 2012 the Extraordinary General Meeting of LOTOS Petrobaltic S.A. adopted a resolution on minority squeeze-out by the majority shareholder, that is Grupa LOTOS S.A.

As part of the squeeze-out process, by December 31st 2012 Grupa LOTOS S.A. acquired 1,421 shares in LOTOS Petrobaltic S.A. with an aggregate value of PLN 179,000, representing 0.0146% of the company's share capital, of which 218 shares with an aggregate value of PLN 28,000, representing 0.0022% of the company's share capital, were recorded in the share register.

Following the acquisition of shares in LOTOS Petrobaltic S.A. from non-controlling shareholders as part of the voluntary share purchase process and the minority squeeze-out, as well as the increase in the share capital of LOTOS Petrobaltic S.A., as at December 31st 2012 Grupa LOTOS S.A. held a 99.96% interest in the share capital of LOTOS Petrobaltic S.A., including 9,935,069 shares entered in the share register, and representing 99.95% of the share capital of LOTOS Petrobaltic S.A.

(3) The shareholding changes described in item (2) above also resulted in changes in Grupa LOTOS S.A.’s indirect interests in the share capitals of the subsidiaries and of the jointly-controlled company of LOTOS Petrobaltic S.A.

(4) On July 31st 2012, Grupa LOTOS S.A. sold 100% of its interests in LOTOS Ekoenergia Sp. z o.o. to the Miliana Shipholding Company Ltd. A change in the company name from LOTOS Ekoenergia Sp. z o.o. to Technical Ship Management Sp. z o.o. was then registered on October 17th 2012.

(5) On November 28th 2012, AB LOTOS Geonafta acquired a 50% interest in UAB Manifoldas. As a result of the transaction, AB LOTOS Geonafta now holds a 100% interest in UAB Manifoldas.

(6) On November 12th 2012, LOTOS Petrobaltic S.A. and Kancelaria Prawna Domański i Wspólnicy sp.k. executed a share purchase agreement whereby LOTOS Petrobaltic S.A. acquired a 100% interest in Baltic Gas Sp. z o.o. Baltic Gas Sp. z o.o. was excluded from consolidation due to the fact that the data disclosed in its financial statements as at December 31st 2012 is immaterial to the performance of the obligation specified in IAS 27 Consolidated and Separate Financial Statements.

(7) On November 12th 2012, LOTOS Petrobaltic S.A. purchased from Kancelaria Prawna Domański i Wspólnicy sp.k. all the rights and obligations in Baltic Gas Spółka z ograniczoną odpowiedzialnością i wspólnicy sp.k., making it the sole limited partner in the company. The general partner in Baltic Gas spółka z ograniczoną odpowiedzialnością i wspólnicy sp.k. is Baltic Gas Sp. z o.o., which was excluded from consolidation due to the fact that the data disclosed in its financial statements as at December 31st 2012 is immaterial to the performance of the obligation specified in IAS 27 Consolidated and Separate Financial Statements.

Structure of the LOTOS Group

As at December 31st 2012

1 State Treasury – 0.01%, employees – 0.04%

2 Limited partner

3 General partner

4 Grupa LOTOS holds 8.97% of the share capital of P.P.P.P. NAFTOPORT Sp. z o.o., a company of the PERN Przyjaźń Group of Płock

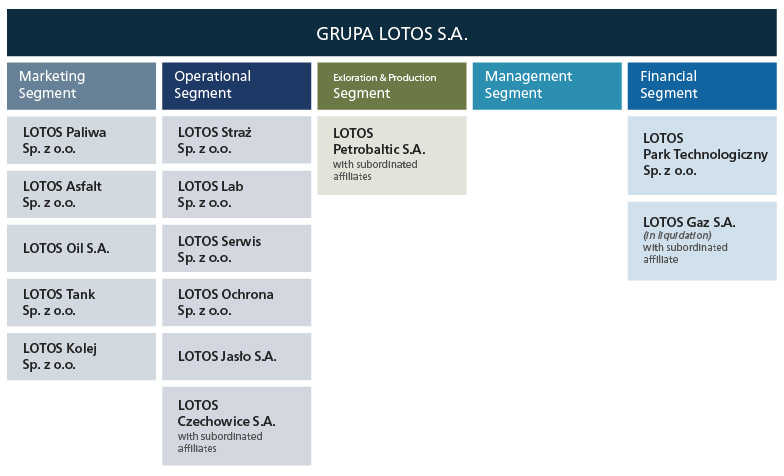

Within the LOTOS Group, the role of Grupa LOTOS as the parent entity is to integrate the key management and support functions.

To this end, Grupa LOTOS has implemented a segmental management model. A segment is understood as a separate area of business activities managed at the Group level by a designated member of the Board of Grupa LOTOS. This model enhances management efficiency, delivering Group-wide cost and revenue synergies. Segmental management provides for consistent implementation of strategy, coordinated planning and controlling, integrated operational management and maintenance of uniform corporate standards.

In the operational activities of the LOTOS Group, the following two main reporting operational segments can be identified:

Extraction operational segment – comprising activities concerning exploration for and exploitation of crude oil and natural gas deposits;

Production and marketing operational segment – comprising activities of companies concerned with production and processing of refined petroleum products as well as their retail and wholesale, and support, transport and servicing activities.

For management purposes, the LOTOS Group is divided into the following business units based on the industry segments:

Management segment – falls within the remit of the President of the Board (i.e. the head of the management segment). The management segment’s activities are focused on increasing the LOTOS Group value through overall management of its operations, including coordination of efforts to formulate corporate strategies, define development directions for individual business areas and coordinate the process support function.

Exploration & production segment – falls within the remit of the Vice-President of the Board in charge of Oil and Gas Exploration & Production (i.e. the head of the E&P segment). The scope of the E&P segment’s activities includes formulation of development strategies for the LOTOS Group in the area of oil and gas exploration and production, as well as management and supervision of these activities.

LOTOS Petrobaltic and its affiliates are part of the exploration & production segment.

Operational segment – falls within the remit of the Vice-President of the Board, Chief Operation Officer (i.e. the head of the operational segment). The operational segment’s tasks include formulation of strategies to maintain and expand production facilities, as well as supervision and coordination of all matters related to the processing of crude oil, refinery production and technologies. Beyond that, the operational segment prepares policy objectives for refinery production, supervises production-related R&D work, coordinates technical and technological development projects, and ensures the requisite technical performance of the LOTOS Group’s assets, safety processes and physical protection.

LOTOS Ochrona, LOTOS Straż, LOTOS Serwis, LOTOS Lab, LOTOS Jasło and LOTOS Czechowice and its affiliates are all part of the operational segment. LOTOS Ochrona was transferred to the operational segment in October 2012. Previously, it had been allocated to the management segment;

Marketing segment – falls within the remit of the Vice-President of the Board, Chief Commercial Officer (i.e. the head of the marketing segment). The marketing segment’s tasks include formulation of marketing strategies as well as effective management of sales, supplies and distribution of crude oil and petroleum products. It is also responsible for the development of trading and optimisation activities.

LOTOS Paliwa, LOTOS Oil, LOTOS Asfalt, LOTOS Kolej and LOTOS Tank are all part of the marketing segment;

Financial segment – falls within the remit of the Vice-President of the Board, Chief Financial Officer (i.e. the head of the financial segment). The Financial segment’s tasks involve monitoring of the implementation of LOTOS Group strategies and overall management of financial and accounting processes. This includes formulation of financial, legal and insurance strategies and monitoring of their implementation, management of budgeting and controlling, development and implementation of financial risk management strategies and overall management of assets and restructuring processes.

LOTOS Park Technologiczny and LOTOS Gaz w likwidacji (in liquidation) and its affiliate are part of the financial segment.

In 2012, there were significant changes to the Grupa LOTOS’ organizational structure, effected as a result of changes in the composition of the Company’s Board. The changes were made to:

- Ensure implementation of the business strategy until 2015,

- Raise the standing, decision-making powers, responsibility and effectiveness of the segments,

- Enhance the management model,

- Minimise management costs,

- Improve segmental reporting,

- Enhance the communication process,

- Optimise areas related to financial and accounting support, CSR and sponsorship, IT management, financial risk management and asset management.

Breakdown of the operational segments

As at December 31st 2012

The corporate structure of Grupa LOTOS reflects its division of competences and the relationship between the various functions and tasks performed at the Company, and specifies the organizational and management hierarchy. As at the end of 2012, the corporate structure of Grupa LOTOS comprised the following units: 15 divisions, including 5 divisions reporting directly to the Chief Executive Officer, 35 offices, 19 departments, and 8 complexes.

E-mail

E-mail Facebook

Facebook Google+

Google+ Twitter

Twitter